Banks and other financial institutions are under pressure to deliver a mobile-first customer experience strategy. Banks are increasingly looking to provide an omnichannel customer experience to retain brand loyalty and meet the ever-increasing expectations of their customers, especially the millennials. According to a 2017 IDC report on mobile messaging in retail banking, SMS will play an important part in the overall mobile banking experience. The use cases of SMS encompass alerts & notifications for breaches, reminders, account status, credit card, and loan application, 2-way broadcast messaging and various updates.

Banks need to meet stringent compliance and governance to protect customer’s information and sensitive transactions. They also need to conduct their daily operations efficiently, cost-competitively, while providing excellent customer services.

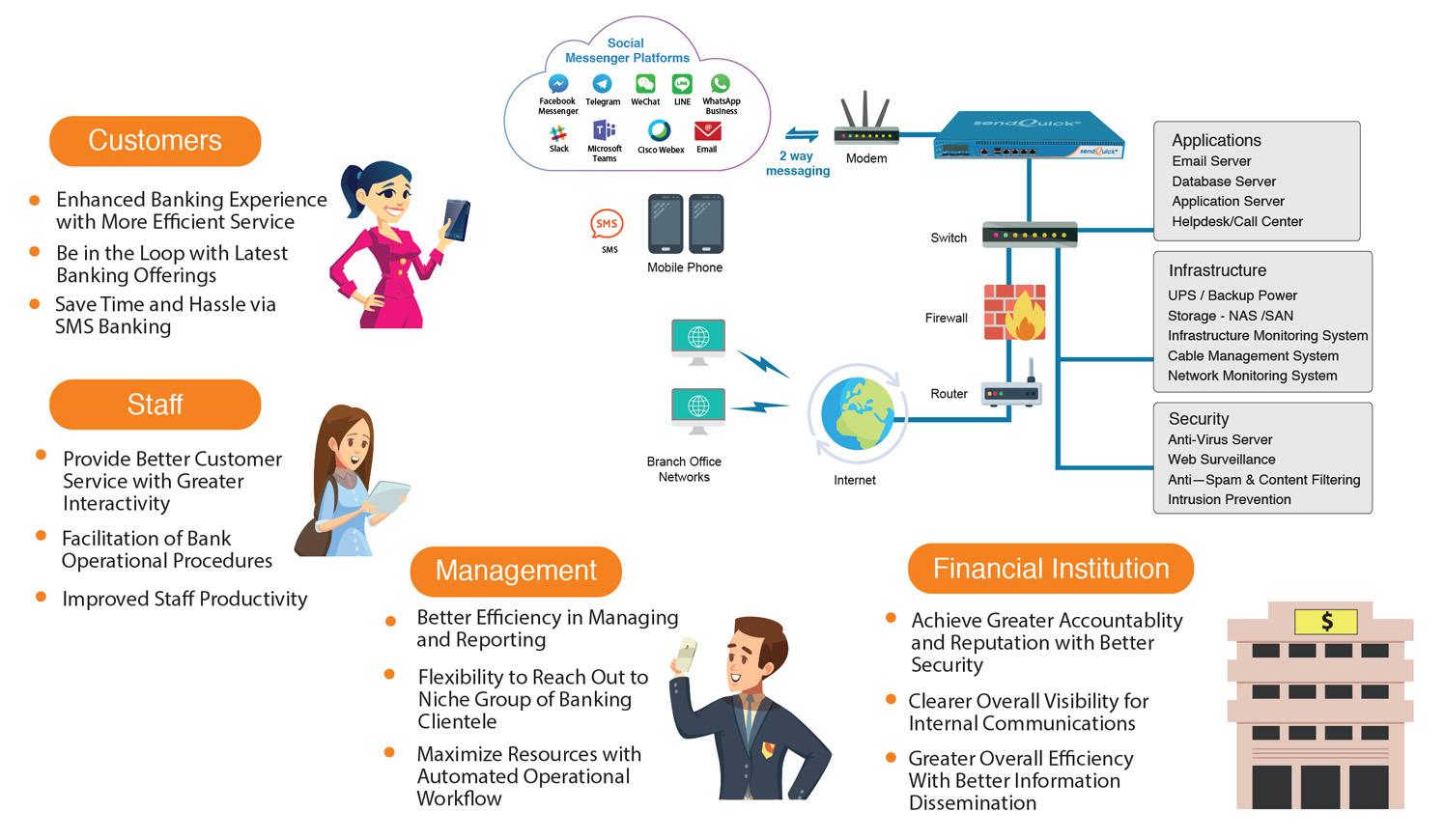

SendQuick is an award winning SMS gateway that companies can use for their omnichannel messaging solutions and deploy it as an effective tool in the banking industry.

Following are 5 ways by which banks can benefit from using SMS alerts in their daily business operations:

1. Integration with CRM to improve operational efficiency

Organisations can integrate our SendQuick SMS gateway with the internal CRM platform to send out automated notifications to customers thereby automating administrative processes and freeing up their resources to focus on higher value customer-centric services. SendQuick can also act as a standalone messaging platform

2. Reducing the risk of data breach using 2-Factor Authentication (2FA)

Customer data security is of utmost importance to banks. To minimise the risk of data breach, banks can implement our SendQuick 2FA via SMS One-Time Password (OTP) solution to provide an extra layer of security while accessing financial information. Our authentication solution can also help customers conduct sensitive transactions conveniently and securely

3. Omnichannel Messaging to enhance the Customer Experience Journey

SendQuick’s omnichannel messaging capabilities enhances the customer experience journey by allowing the bank staff to reach the customers through multiple channels. Bank personnel can send various updates such as account opening, loans, and credit card application status, reminders, alerts via SMS, Email, Social Messengers, and Collaboration tools

4. Improve IT responsiveness by reducing downtime of outages

Our solutions can help IT departments response faster to applications, systems, web services, or network outages by active 2-way remote monitoring. For any abnormality detected, SendQuick will activate the multi-level escalation of instant alerts & notifications to personnel on-standby duty. With timely response by the IT team through this, it would minimize business disruptions which could be damaging to your reputation and profitability

5. Boost Interactivity with 2-Way messaging

Banks can tap on the 2-way messaging feature provided by the SendQuick to increase interaction and engagement with the customer